How to Declare Income. Calculations RM Rate TaxRM A.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

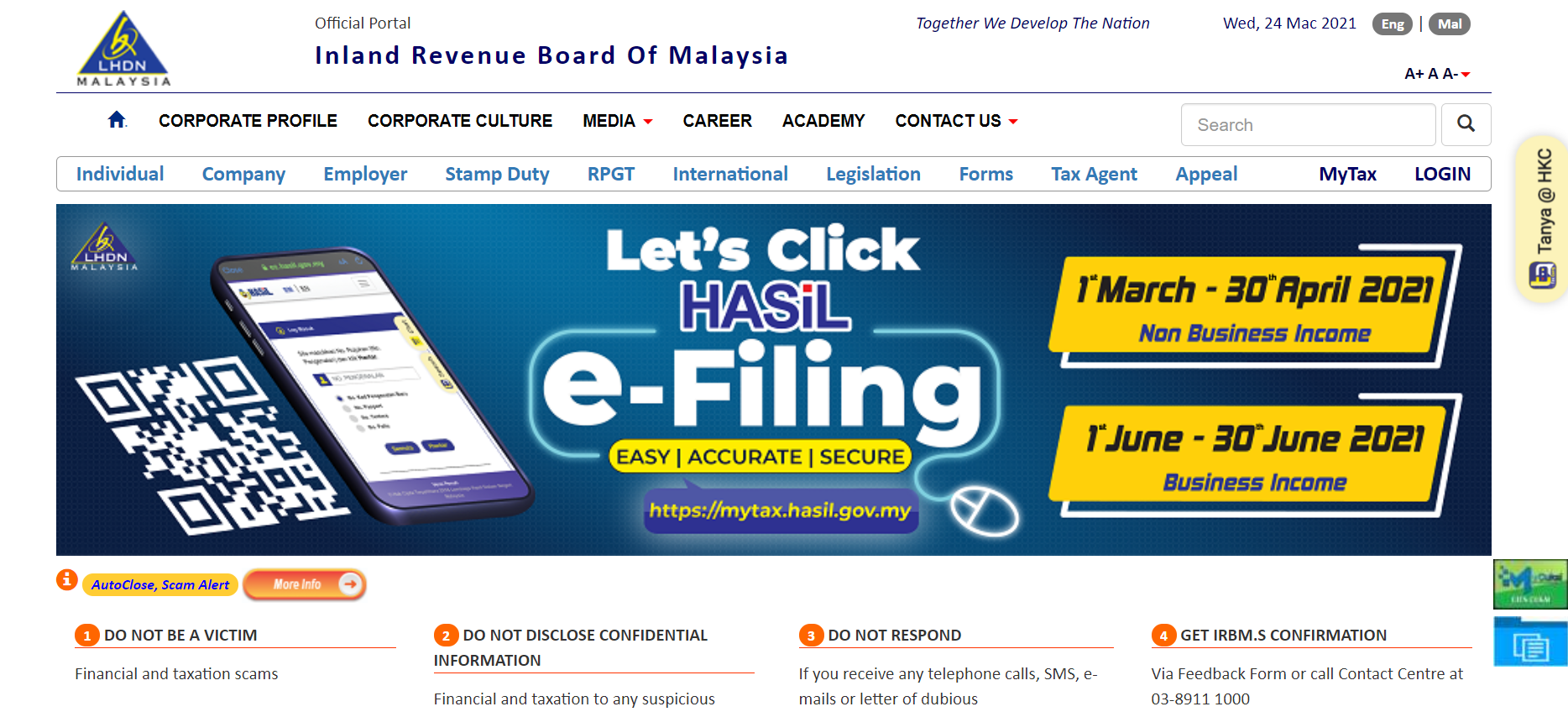

You can file electronically by.

. For the BE form. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. For example if your total.

An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made. Prepare a tax return if you earned income. The rental income commencement date starts on the first day the property is rented out.

Now its time to file your taxes and hopefully get a tax refund. She explained Under Malaysias taxation system gratuity would be taxed under s13 1 a while the loss of employment would be taxed under s13 1 e of the Income Tax. On the First 5000.

Basis Period for Company. If youre not sure what counts as income that you have to declare for tax purposes weve elaborated more on this in a later sub-section of this guide How To File. Change In Accounting Period.

Employment income includes salary. An individual who earns more than RM34000 per year approximately RM2833 is considered high earner. Self assessment means that taxpayer is required by law to determine his taxable income compute chargeable income tax submit the income tax return form and make tax payment.

Click on e-Filing PIN Number Application on the left and then click on. In the rental income column enter the rental income paid by the tenant. How to Declare Income.

Line 7 of Form 1040 reports. Who Must Declare Income Tax In Malaysia. How To Declare Income Tax Malaysia.

If youre not sure what counts as income that you have to declare for tax purposes or not scroll down to our section on stating your income below. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30. Well be helping you all the way with a step-by-step guide for filing your income tax in Malaysia 2022 YA.

Arts and Culture Malaysia and entrance fees to tourists attractions incurred on or after 1st March 2020. Click on Permohonan or Application depending on your chosen language. Amending the Income Tax Return Form.

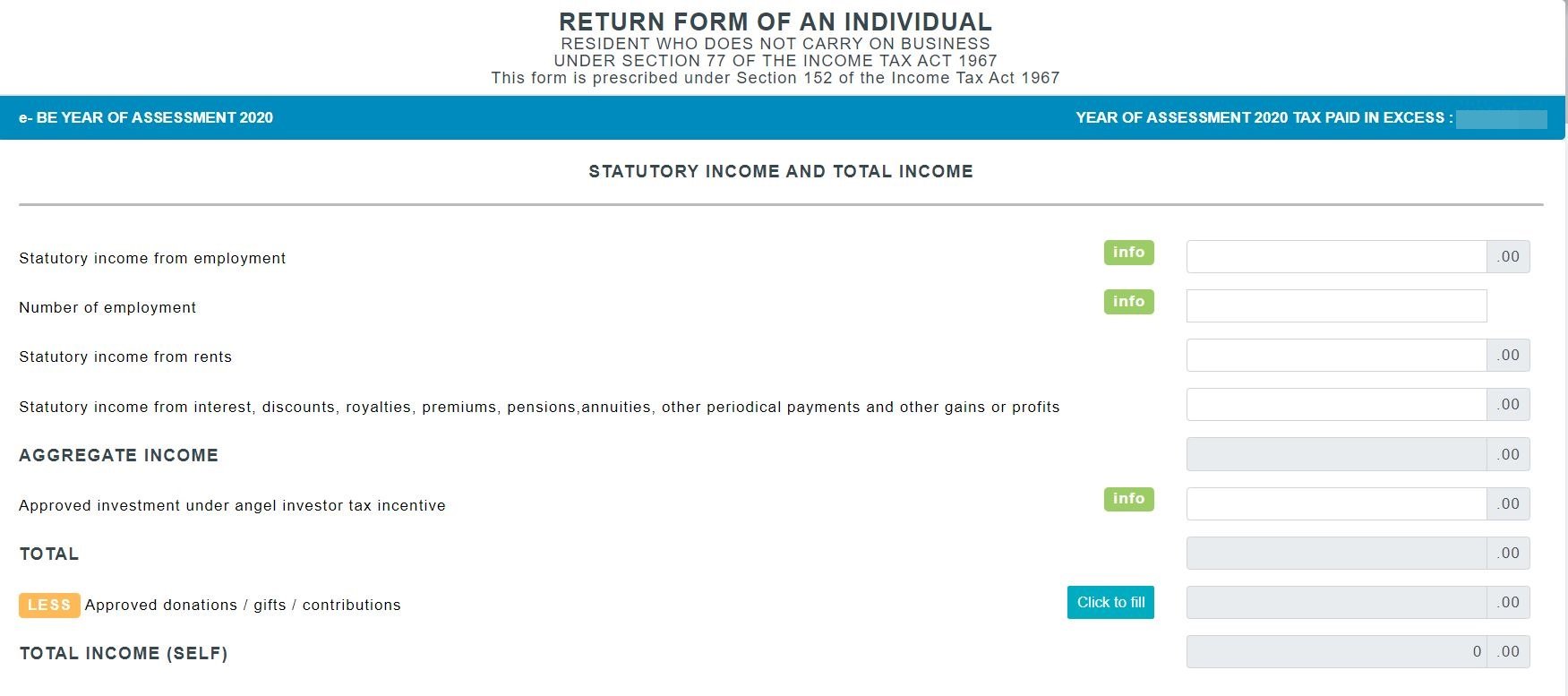

Must y Income Tax. Foreigners who qualify as tax-residents follow the same tax. In this form you will be able to declare your side income under Statutory income from interest discounts royalties pensions annuities other periodical payments and other.

Thats a lot of money people. Long answer - If caught by the LHDNs auditor youll face a penalty ranging from 80 to 300 of the taxable amount. Once you have logged in under the e-filing section click on e-Borang and that will take you to your tax e-filing form.

With this affected individuals can continue to enjoy the exemption from 1 January 2022 to 31 December 2026. You can also declare any tax incentives you have received at this step. Non-resident stays in Malaysia for less than 182 days and is employed for at least 60 days in a calendar year.

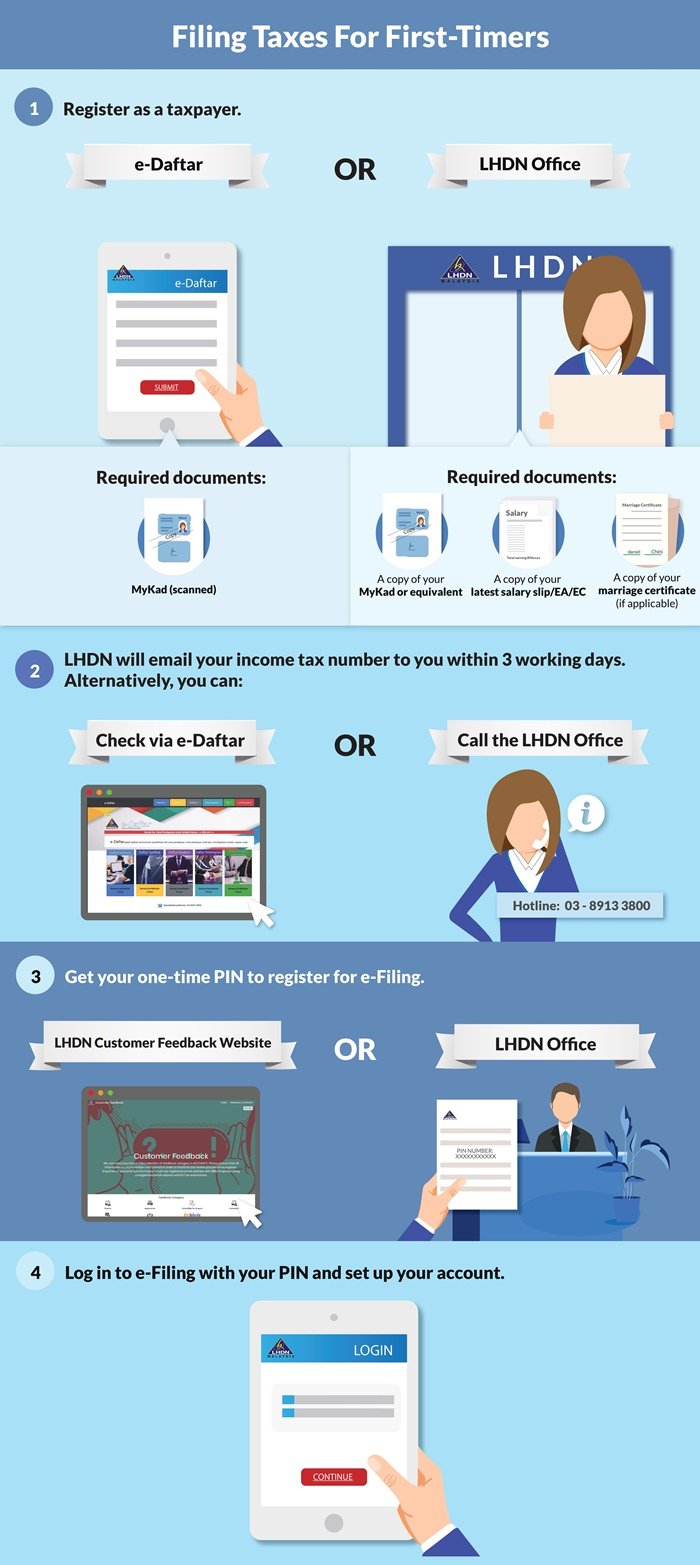

This is with the exception of those who carry out partnership. Register as a first-time tax payer online. On the First 5000 Next.

The usual procedure for reporting foreign income is the same as that for reporting domestic income. How Do I Declare My Income Tax Online Malaysia. 1 Self Assessment System SAS is based on the concept of Pay Self Assess and File.

If you have never filed your taxes before on e-Filing income tax Malaysia 2022. A step-by-step guide for using LHDN MalaysiaA for e-filing is included below. Using a separate ledger record each rental propertys description at the top of each page.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

7 Tips To File Malaysian Income Tax For Beginners

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To Step By Step Income Tax E Filing Guide Imoney

Guide To Using Lhdn E Filing To File Your Income Tax

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

How To File For Income Tax Online Auto Calculate For You

Cukai Pendapatan How To File Income Tax In Malaysia

How To File Your Taxes For The First Time

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Guide To Using Lhdn E Filing To File Your Income Tax

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Malaysia Personal Income Tax Guide 2021 Ya 2020

The Complete Income Tax Guide 2022

Malaysia Personal Income Tax Guide 2022 Ya 2021

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How To File For Income Tax Online Auto Calculate For You